Hey guys, it’s Finance Fridays… and I’m sick again…or maybe it’s allergies from the vog or something. Either way I got up late and that’s why this post is late. However, I was able to fix my problem with WP-Admin dashboard not working, so at least there’s that. This post will be a short about Social Security.

Stock Photo from: Pexels

What is Social Security?

I think everyone kind of has a general idea of what Social Security is. Essentially, while you work you are paying into the Social Security program, and then when you retire you are able to receive a monthly payment from the government. The Social Security Administration (ssa.gov) has a nice history here: Brief History

The TL;DR of the history was that there were many prior iterations of things similar to Social Security before Social Security as we know it was signed into law in 1935. The impetus for what became Social Security was Stock Market Crash of 1929 and the Great Depression that followed. Many saw their whole retirement/savings evaporate almost overnight.

Excerpt from ssa.gov

“Millions of people were unemployed, two million adult men (“hobos”) wandered aimlessly around the country, banks and businesses failed and the majority of the elderly in America lived in dependency.”

During this time, many movements and plans existed which you can read about in the Brief History above (I found it interesting, so I did).

Another excerpt from ssa.gov

“The Social Security Act was signed into law by President Roosevelt on August 14, 1935. In addition to several provisions for general welfare, the new Act created a social insurance program designed to pay retired workers age 65 or older a continuing income after retirement.”

The full text of the original 1935 Social Security act is here.

Social Security has been amended multiple times since its creation, to what we have today, which is still pretty complex in the way it is handled.

Why do you never consider Social Security in your retirement calculations?

Oh… you noticed that? I exclude it on purpose.

It is unclear how important Social Security will be for my generation, or the generation after mine. The generation before mine (my parents and inlaws) already have a good idea of what they will receive and so it’s reasonable to include it in their retirement plans.

However, for my generation, and the generation after mine, I would not rely upon it. Additionally, even if you tried to account for it, it would be difficult because there are still 30 more years before we retire for additional amendments to be made. Many think that Social Security is going bankrupt. However, I prefer to go straight to the source.

Excerpt from ssa.gov

“As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.1 At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits. Thus, the Congress will need to make changes to the scheduled benefits and revenue sources for the program in the future. The Social Security Board of Trustees project that changes equivalent to an immediate reduction in benefits of about 13 percent, or an immediate increase in the combined payroll tax rate from 12.4 percent to 14.4 percent, or some combination of these changes, would be sufficient to allow full payment of the scheduled benefits for the next 75 years.” (emphasis mine)

For my generation, our retirement is probably expected to be 30 years from now, when I will be 65, which is 2046. This is way after the projected 2037 date when Social Security will be exhausted. However, I do realize Social Security is a very well-liked government program and I really doubt it will go away completely. However, as stated above, you can expect either a reduction in benefits or increase in taxes (or maybe some degree of both).

Uncertainty of this degree is not allowed in retirement plans.

Even so, you can still estimate it right?

Yes, you can, but I don’t think someone in my generation should.

However, let’s do a hypothetical at the ssa.gov calculator.

Let’s use January 1, 1980, $250,000, last year of earning will be 2045 where you made $250,000, and you retire January 2046.

“Your estimated monthly benefit amount, beginning at age 66 and 1 month in 2046, is $2,817.00″

But wait, let’s click See the Earnings We Used.

It assumes you were taxed in 1997 when you turned 18 and just continued from there. However, as a medical student, you were most likely in college 18-22, and medical school 22-26. You didn’t start earning money until you were in residency. So if we assume you were on the normal “Track“, then we should adjust the numbers.

1997-2004 would include your undergraduate and medical school, which should essentially be 0, unless you were doing work-study or had a part-time job. Let’s just assume zero to make it easy. You then start paying the maximum taxable amount in 2005 until you retire in 2046, assuming the maximum taxable amount doesn’t increase (but it will). Either way, you’ll almost always be paying the maximum so the taxable maximum changing doesn’t matter.

Now let’s resubmit:

“Your estimated monthly benefit amount, beginning at age 66 and 1 month in 2046, is $2,815.00.”

You paid less into Social Security according to their calculations so you make $2 less a month.

But will that really be true?

Wait a second… what about this “inflated (future) dollars ” option?

If you use the same numbers as above, but select the inflated (future) dollars option you get:

“Your estimated monthly benefit amount, beginning at age 66 and 1 month in 2046, is $8,022.00.”

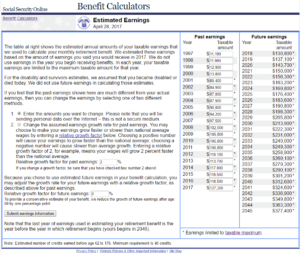

WHOA… but then let’s look at “See Earnings We Used”. This was kind of busy image, so I just screen shotted it:

[Click to Enlarge]

This makes the assumption that you salary will go up every year, and your maximum taxable will go up every year. The variability in this calculation is wide. The possibility may arise some day that every dollar of your paycheck will have some % of it go to Social Security, if you believe that chart.

For this reason, my generations social security benefit is nearly impossible to calculate.

However, for a “floor”, the calculation above of $2815 a month is probably reasonable.

Hey, $2815 a month isn’t bad.

You’re right, $2815 isn’t bad… today in 2017. But what is its buying power in 2046?

Let’s use the handy dandy inflation calculator.

If you want $2815 in 2046 and assume 2.5% inflation (the default), then it’s worth about $1400 in today’s dollars.

I see… so what’s the safest thing to do?

It’s what I just said… assume you don’t have it. Just like my pension.

I assume I don’t have either my social security or my pension (or my wife’s). All of my retirement calculations are based solely on our 403b/401k/457/IRA contributions.

If, in 2035 or 2040 or whatever, the pension and social security are there, then it may be time to value them again and maybe I can retire early if I want.

Isn’t that kind of too conservative?

Perhaps, but remember what I said. “Ignorance is Bliss works both ways.”

Having extra money come up for your retirement that you didn’t know you had will help provide some additional flexibility and the option to retire early.

TL;DR

Social Security isn’t going anywhere, it’s too popular. Even so, I wouldn’t depend on it.

For my generation, we have 30 years for it to be amended over and over.

Calculating your benefit is also very difficult because it relies on future “guesses” to the maximum taxable amount.

However, the “floor” is probably $2815/month… but in 2046, that’s $1400 in today’s dollars.

My advice is just assume Social Security (like your pension), don’t exist.

Can’t spend money that you never knew you had.

-Sensei

Agree? Disagree? Questions, Comments and Suggestions are welcome.

You don’t need to fill out your email address, just write your name or nickname.

Like these posts? Make sure to subscribe to get email alerts!